As U.S. competition authorities ponder whether age-old antitrust laws should be modernized to apply to tech giants, a first-order question is: What existing antitrust laws apply to their conduct? A formerly formidable tool that has been defanged through lax enforcement is the Robinson–Patman Act (RPA). Passed by Congress in 1936, the RPA was drafted in response to a growing public concern that large chain stores were squeezing out small businesses. The RPA strengthened the Clayton Act’s prohibition of “secondary-line” price discrimination—that is, price discrimination by a wholesaler that favors some retailers over others. The FTC and DOJ, however, have been unwilling to enforce the RPA since the 1980s, as they have increasingly perceived the RPA’s protectionist bent as orthogonal to the consumer-welfare standard espoused by other federal antitrust laws. But enforcers could revive the RPA if there is political will. The Supreme Court, in its most recent RPA case, Volvo Trucks North America, Inc. v. Reeder-Simco GMC, Inc., reaffirmed some of the most important aspects of the RPA, which arguably goes much further to protect small businesses than any other existing antitrust law. This Comment examines how the RPA could potentially be applied to the modern-day giant retailer Amazon. While such a case would depend on the fact-specific allegations, this Comment explores arguments in support of a claim that Amazon, as a buyer, has induced wholesalers to price discriminate against smaller retailers. In doing so, this Comment also highlights some of the limitations of trying to apply antitrust laws to America’s largest online retailer.

Introduction

In the lively national debate about how the U.S. antitrust framework should be updated to address the concentration of power in digital markets, the Robinson–Patman Act (RPA) is not front and center. 1 See, e.g., House Judiciary Subcomm. Antitrust, Com. & Admin. L., Report: Investigation of Competition in Digital Markets 402 (2020). The 450-page House Judiciary Committee Report, released in 2020 after a bipartisan investigation into the dominance of U.S. tech giants, cited the RPA just once as an underenforced provision. See id. The RPA, which bans a seller from charging competing buyers different prices for the same “commodity,” has been subject to longstanding criticism for promoting protectionist goals. 2 See D. Daniel Sokol, Analyzing Robinson-Patman, 83 Geo. Wash. L. Rev. 2064, 2066–67 (2005) (describing, and contributing to, the longstanding and prevalent critiques of the Act by both practitioners and academics). As the Chicago School economics-based approach to antitrust took hold throughout the 1970s and 1980s, 3 See Elizabeth Popp Berman, How to Govern Markets, in Thinking Like an Economist: How Economics Became the Language of U.S. Public Policy (forthcoming 2022) (manuscript at ch. 1) (on file with the Columbia Law Review) (describing the institutionalization of the economic style of reasoning in antitrust policymaking); William E. Kovacic, The Intellectual DNA of Modern U.S. Competition Law for Dominant Firm Conduct: The Chicago/Harvard Double Helix, 2007 Colum. Bus. L. Rev. 1, 13–15. an ideological consensus emerged within both academic and policy circles that the overenforcement of the RPA could reduce competition and thereby “harm” consumers. 4 See, e.g., Richard A. Posner, The Robinson-Patman Act: Federal Regulation of Prices Differences 49–53 (1976); Phil C. Neal, William F. Baxter, Robert H. Bork, Carl H. Fulda, William K. Jones, Dennis G. Lyons, Paul W. MacAvoy, James W. McKie, Lee E. Preston, James A. Rahl, Richard E. Sherwood & S. Paul Posner, Task Force on Antitrust Policy, Report of the White House Task Force on Antitrust Policy, 2 Antitrust L. & Econ. Rev. 11, 11, 13 (1968–1969). In 1977, the DOJ produced a report that found that the RPA’s prohibition on secondary-line price discrimination chilled competition and produced inefficiencies. 5 See DOJ, Report on the Robinson-Patman Act 75–76, 99, 209–10 (1977). In 2007, a congressionally appointed, bipartisan Antitrust Modernization Committee (AMC) called for the repeal of the RPA altogether based on similar reasoning. 6 Deborah A. Garza, Jonathan R. Yarowsky, Bobby R. Burchfield, W. Stephen Cannon, Dennis W. Carlton, Makan Delrahim, Jonathan M. Jacobson, Donald G. Kempf, Jr., Sanford M. Litvack, John H. Shenefield, Debra A. Valentine & John L. Warden, Antitrust Modernization Comm’n, Report and Recommendations, at i, iii, 1, 312 (2007) https://digital.library.unt.edu/ark:/67531/metadc1228317/m1/5/ (on file with the Columbia Law Review) (citing “the Act’s high costs, limited or nonexistent benefits, and inconsistency with other antitrust laws”). The FTC and the DOJ have consequently not enforced the RPA in the last four decades. 7 Sokol, supra note 2, at 2066–67, 2074–76. Although private plaintiffs have continued to file suit under the RPA, the likelihood of winning an RPA case in the courts has plummeted. 8 See Ryan Luchs & Kannan Srinivasan, The End of the Robinson-Patman Act? Evidence From Legal Case Data, 56 Mgmt. Sci. 2123, 2124 (2010) (analyzing twenty-eight years of data from RPA cases between 1982 and 2010 and finding that a private plaintiff’s likelihood of winning an RPA challenge, which was 35% between 1982 and 1993, dropped to less than 5% between 2006 and 2010). Courts have more readily assumed the procompetitive effects of secondary-line price discrimination that is barred under the RPA—namely, retailers bargaining aggressively to extract lower prices from suppliers. 9 See Mark A. Glick, David G. Mangum & Lara A. Swensen, Towards a More Reasoned Application of the Robinson-Patman Act: A Holistic View Incorporating Principles of Law and Economics in Light of Congressional Intent, 60 Antitrust Bull. 279, 291–92 (2015) (explaining that the Supreme Court has established a “presumptively favorable treatment of functional discounts,” putting the burden on the plaintiff to preserve the claim of competitive injury otherwise negated by a functional discount).

The RPA was originally conceived to protect small businesses against large chain stores’ rapid expansion of power from the 1920s to the 1940s. 10 See Sokol, supra note 2, at 2069. Chain stores transformed retailing, altering the landscape previously marked by local merchants and independent stores in grocery, variety store, apparel, and retail drug markets. 11 Richard C. Schragger, The Anti-Chain Store Movement, Localist Ideology, and the Remnants of the Progressive Constitution, 1920–1940, 90 Iowa L. Rev. 1011, 1013 (2005). Between 1920 and 1930, the top twenty chain stores more than doubled in size of operation. 12 Glick et al., supra note 9, at 282 (citing Godfrey Lebhar, Chain Stores in America, 1859–1962, at 55–56 (1958) (noting that the top twenty chains grew by more than 250%—from 9,912 to 37,524 stores—between 1920 and 1930)). The Great Atlantic and Pacific Tea Company (A&P), which epitomized this revolution, 13 See Schragger, supra note 11, at 1013 (describing the company as leading the transformation). became the fifth-largest industrial corporation in the United States, reigning over 15,700 stores by 1930. 14 Id.

This explosive growth triggered backlash from a wide spectrum of opponents—including independent merchant associations, antimonopolists, agrarians, populists, and progressives—who argued that chain store expansion must be curtailed not only to protect small-scale distributors from being eliminated but also to promote greater economic decentralization. 15 See id. at 1014–15. These advocates called on the regulatory state to intervene and curb the forces of corporate capitalism that threatened local economic self-sufficiency and political independence. 16 See id. at 1016. At the state level, small business lobbies effectively mobilized to introduce 1,312 anti-chain tax laws, 62 of which were successfully enacted between 1923 and 1961. 17 Glick et al., supra note 9, at 282. At the federal level, the salience of this anti-chain-store sentiment and the localist ideology united Democrats, Republicans, and Progressives to pass the RPA in 1936. 18 See Schragger, supra note 11, at 1067–70 (explaining that the Act “passed overwhelmingly in the Senate and the House,” which reflects the “pervasiveness and attractiveness of a localist, producerist ideology”).

Arguments made by today’s advocates against Amazon’s business practices—that Amazon has contributed to wage stagnation, 19 See Ro Khanna & Marc Perrone, American Workers Need Congress to Stand Up to Amazon and Walmart, Hill (Feb. 28, 2019), https://thehill.com/blogs/congress-blog/economy-budget/431867-american-workers-need-congress-to-stand-up-to-amazon-and [https://perma.cc/ZA87-52YV] (suggesting that the largest corporations, like Amazon, have refused to pay living wages for their employees, which has contributed to wage stagnation). labor abuses, 20 See Erika Hayasaki, Amazon’s Great Labor Awakening, N.Y. Times Mag. (Feb. 18, 2021), https://www.nytimes.com/2021/02/18/magazine/amazon-workers-employees-covid-19.html (on file with the Columbia Law Review) (last updated June 15, 2021) (explaining that the COVID-19 pandemic has triggered employees to voice concerns about working conditions at Amazon warehouses). the financial insecurity of suppliers and competitors, 21 See Annie Palmer & Jordan Novet, Amazon Bullies Partners and Vendors, Says Antitrust Subcommittee, CNBC (Oct. 6, 2020), https://www.cnbc.com/2020/10/06/amazon-bullies-partners-and-vendors-says-antitrust-subcommittee.html [https://perma.cc/KCR9-CFV2] (describing how Amazon uses its power to threaten partners and vendors with dire financial consequences should they not agree to Amazon’s terms in negotiations). and the decline of brick-and-mortar retailers—parallel those made by the anti-chain-store advocates of the 1920s and 1930s. 22 See Schragger, supra note 11, at 1114–18 (explaining that a wide range of groups opposed chain stores due to wage pressures and their role in squeezing out independent retailers, eliminating small-town markets, and diverting money out of the South); H. Claire Brown, The Wild Story of How America Almost Banned Chain Grocery Stores, Counter (Apr. 23, 2019), https://thecounter.org/ap-food-retail-small-business-grocery-chain-store-ban/ [https://perma.cc/2T3Y-9M2V] (“Advocates worried that the proliferation of chains would suppress wages. They worried that chains would accrue enough market power to force farmers and manufacturers to accept lower prices.”). While the Congress enacting the RPA may not have anticipated the precise business model of e-commerce platforms, Amazon’s role as a retail distributor for wholesalers for a wide variety of products puts it within the category of large retailers that Congress intended to constrain through the statute. As the COVID-19 pandemic has forced consumers to rely even more on e-retailers like Amazon to provide delivery services under social distancing rules, Amazon’s growth as a distributor of essential goods will only trigger more regulatory scrutiny going forward. 23 See Alana Semuels, Many Companies Won’t Survive the Pandemic. Amazon Will Emerge Stronger Than Ever, Time (July 28, 2020), https://time.com/5870826/amazon-coronavirus-jeff-bezos-congress/ (on file with the Columbia Law Review) (discussing Amazon’s growth during the COVID-19 pandemic, driven by an increase in online shopping due to social distancing measures).

If enforcement agencies or private plaintiffs decide to mobilize the currently dormant RPA against Amazon, the giant e-retailer would not come out unscathed. The government could sue Amazon for using its market power to “extort” cheaper prices from wholesalers and thereby induce wholesaler price discrimination against equally situated distributors. If liability is found, the court could order Amazon to discontinue the “discriminatory” wholesale pricing for its suppliers. 24 Section 2(f) of the RPA imposes liability on favored buyers when they “knowingly . . . induce or receive a discrimination in price which is prohibited” by the Act. 15 U.S.C. § 13(f) (2018). Amazon would be the favored buyer in this case. Private plaintiffs could also recover treble damages for injuries they sustained as a result of RPA violations. 25 Id. § 15(a); see also Roger D. Blair & Christine Piette Durrance, Private Damage Actions Under the Robinson-Patman Act, 60 Antitrust Bull. 384, 387 (2015) (explaining that jurisprudence limits recovery by private plaintiffs under the RPA to those who can prove antitrust injury).

This Comment revisits the principles underlying the RPA and demonstrates how federal antitrust enforcement agencies, as well as private plaintiffs, could potentially leverage them against a modern e-retailer like Amazon. 26 The optimal level of RPA enforcement given its overall economic and social impact is beyond the scope of this Comment. This Comment explores the realm of possibilities, given the opportunity and risk of RPA litigation. Specifically, Part I discusses the modern RPA framework under the Supreme Court’s recent RPA case, Volvo Trucks North America, Inc. v. Reeder-Simco GMC, Inc., and how the Court’s decision upheld this framework and affirmed the RPA’s goal of protecting small businesses. Part II illustrates how the RPA could be applied to bring a second-line antitrust injury claim against Amazon.

I. The Robinson–Patman Act and the Volvo Decision

The RPA differs from other federal antitrust laws in that its primary goal is to protect small businesses from aggressive competition. 27 John B. Kirkwood, The Robinson-Patman Act and Consumer Welfare: Has Volvo Reconciled Them?, 30 Seattle Univ. L. Rev. 349, 349 & n.2 (2007) (citing Gilde Breidenbach and Terry Calvani, Former FTC Commissioner and author of the Commission decision in In re General Motors Corp., 103 F.T.C. 641 (1984), who stated that “the underlying predicate of the Robinson-Patman Act was not consumer welfare”). To address concerns about large chain retailers exploiting their market power to undercut smaller retailers, Congress tightened the 1914 Clayton Act’s proscription against “secondary-line” discrimination—that is, discrimination by a seller who favors some of its customers over others. 28 See Volvo Trucks N. Am., Inc. v. Reeder Simco GMC, Inc., 546 U.S. 164, 165–66, 175 (2006) (explaining that Congress was responding “to the advent of large chain stores, enterprises with the clout to obtain lower prices for goods than smaller buyers could demand”). The RPA also prohibits “primary-line” injury—or predatory pricing—that occurs when a retailer’s conduct injures a discriminating seller’s direct competitors; and “tertiary-line” injury, which involves injury to the competition at the level of the purchaser’s customers. See id. at 176. But Congress specifically added language to section 2(a) of the Clayton Act, 15 U.S.C. § 13(a), relaxing the injury requirement in a secondary-line case. See Kirkwood, supra note 27, at 349–50 n.3. Establishing a secondary-line injury claim requires that (1) the relevant sales were “made in interstate commerce,” 29 Gulf Oil Corp. v. Copp Paving Co., 419 U.S. 186, 194–95 (1974). (2) the goods sold were of “like grade and quality,” 30 Fed. Trade Comm’n v. Borden Co., 383 U.S. 637, 639 (1966). (3) the defendants “discriminate[d] in price” between two purchasers of the same goods,” 31 Volvo, 546 U.S. at 175–76 (quoting 15 U.S.C. § 13(a)); Hasbrouck v. Texaco, Inc., 663 F.2d 930 (9th Cir. 1981), aff’d, 496 U.S. 543, 558 (1990). and (4) the price discrimination injured, destroyed, or prevented competition to the discriminator’s advantage. 32 Volvo, 546 U.S. at 177. This last prong—requiring a showing of “competitive injury”—has been the source of much controversy. Courts have interpreted this to require harm to competitors rather than harm to competition, in stark contrast to other federal antitrust laws. 33 Glick et al., supra note 9, at 279–80.

Early in RPA jurisprudence, the Supreme Court affirmed that the RPA meant to curb injury to the “competitor victimized by discrimination.” 34 Fed. Trade Comm’n v. Morton Salt Co., 334 U.S. 37, 49–51 (1948) (emphasis added). In FTC v. Morton Salt Co., the Court established a plaintiff-friendly rule that competitive injury could be inferred from evidence of prolonged price discrimination over time. 35 See id. at 49–51. The Court explained that this presumption, which has come to be known as the Morton Salt doctrine, was justified given that competitors would most likely be injured if they were forced to pay their suppliers higher prices than their competition over a prolonged period. 36 Id. at 46–47. Upon a review of the Act’s legislative history, the Morton Salt Court noted that the purpose of the RPA was to address the “evil” arising from the fact that “a large buyer could secure a competitive advantage over a small buyer solely because of the large buyer’s quantity-purchasing advantage.” 37 Id. at 43.

But the Supreme Court’s subsequent cases made it difficult for plaintiffs to prevail on an RPA claim by expanding what defendants could raise as affirmative defenses and heightening requirements to build a prima facie case. 38 Kirkwood, supra note 27, at 350 (“Between 1979 and 1993, the [Supreme Court] decided four Robinson-Patman Act cases and in all four adopted interpretations that made it harder for plaintiffs to prevail, either by ‘expanding affirmative defenses [or] heightening requirements for a prima facie case.’”). This trend, driven in large part by Chicago School scholarship in the 1970s and 1980s, reflected a growing consensus that consumer welfare is the singular economic goal of U.S. antitrust law. 39 See Robert H. Bork, The Antitrust Paradox: A Policy at War With Itself 51 (1978) (explaining that the “only legitimate goal of American antitrust law is the maximization of consumer welfare”). As an economic matter, the Chicago School scholars argued that shielding smaller, inefficient competitors from aggressive competition by large retailers would lead to higher prices and market inefficiency. 40 Id.; see also Roger D. Blair & Christina DePasquale, “Antitrust’s Least Glorious Hour”: The Robinson-Patman Act, 57 J.L. & Econ. S201, S203 (2014) (“Persistent price differentials are apt to reflect cost differences across customers . . . . To the extent that the Robinson-Patman Act inhibits such price differentials, more efficient firms will be denied a lower price, which in turn harms consumers.”). Whether or not this economic analysis is sound is not debated in this Comment.

The Court’s decision in Brooke Group Ltd. v. Brown & Williamson Tobacco Corp. in 1993 seemed to add further weight to the view that procompetitive goals of the Sherman Act and the FTC Act should also constrain the application of the RPA. 41 Brooke Grp. Ltd. v. Brown & Williamson Tobacco Corp., 509 U.S. 209, 220 (1993). The Court declared that the RPA should be “construed consistently with broader policies of the antitrust laws” and that the Act bans “price discrimination only to the extent that it threatens to injure competition.” 42 Id. The Court effectively imported the Sherman Act’s injury-to-competition standard to apply to RPA claims for primary-line injury or predatory pricing 43 See id. at 222–23. —which occurs when one manufacturer reduces its prices in a market and causes injury to its competitors in the same market. 44 Price Discrimination: Robinson-Patman Violations, FTC, https://www.ftc.gov/tips-advice/competition-guidance/guide-antitrust-laws/price-discrimination-robinson-patman [https://perma.cc/P6AZ-FWWJ] (last visited Aug. 22, 2021). But the question remained as to whether the Court would apply a heightened evidentiary standard to secondary-line injury cases as well. 45 See Blair & DePasquale, supra note 40, at S212.

In the latest decision involving a secondary-line case, the Supreme Court did not overturn the Morton Salt doctrine or other basic features of the RPA that fundamentally make the legislation protectionist. But it did continue to heighten the competitive injury requirement. 46 See Volvo Trucks N. Am., Inc. v. Reeder-Simco GMC, Inc., 546 U.S. 164, 169 (2006). The Court granted certiorari to the appellants in Volvo Trucks North America, Inc. v. Reeder-Simco GMC, Inc., where a car dealer alleged that the car manufacturer Volvo offered the dealer different wholesale prices than it did for other dealers in a competitive bidding process. 47 See id. at 169–74. Justice Ruth Bader Ginsburg, writing for the majority, found that the plaintiff dealer, Reeder, failed to show requisite competitive injury where Reeder and other dealers were not both “in actual competition” for the same customer under the Act. 48 Id. at 177. She rejected Reeder’s evidence that it received smaller concessions than other dealers from Volvo for different sales on which Reeder did not bid. 49 See id. at 177–78 (rejecting Reeder’s “purchase-to-purchase” and “offer-to-purchase” comparisons of concessions received by Reeder to concessions received by Volvo dealers, which suggested that Reeder received smaller concessions for both successful (purchase) and unsuccessful (offer) bids against non-Volvo dealers than Volvo dealers received on different sales for which Reeder did not bid). On the two occasions in which Reeder did bid against another Volvo dealer, competing “head-to-head” for the same customer, the Justice held that Reeder did not show that discrimination was substantial. 50 Id. at 179–80. The loss of only one sale to another Volvo dealer, which amounted to $30,000 in gross profits, was not of such “magnitude” as to substantiate Reeder as a “disfavored” purchaser. 51 Id. at 180.

By allowing only the “head-to-head” comparison to be considered, Justice Ginsburg narrowed what type of evidence suffices to show undue price discrimination among “favored and disfavored purchasers” under the Act. 52 See Simon A. Rodell, Case Comment, Antitrust Law: The Fall of the Morton Salt Rule in Secondary-Line Price Discrimination Cases, 58 Fla. L. Rev. 967, 973 (2006). Justice Ginsburg echoed Brooke Group’s language that interbrand competition is the “primary concern of antitrust law.” 53 Volvo, 546 U.S. at 180. Her opinion did seem to narrow the range of scenarios in which a manufacturer could injure similarly situated resellers, expanding “procompetitive” ways in which a large buyer could legally induce price discrimination. 54 Id. at 180–81 (“Interbrand competition, our opinions affirm, is the ‘primary concern of antitrust law.’ The Robinson–Patman Act signals no large departure from that main concern. . . . [W]e would resist interpretation geared more to the protection of existing competitors than to the stimulation of competition.”) (quoting Continental T.V., Inc. v. GTE Sylvania Inc., 433 U.S. 36, 51–52, 52 n.19 (1977)).

Justice John Paul Stevens, in his dissent in Volvo, expressed concern that Justice Ginsburg’s transaction-specific approach eliminated the RPA’s statutory protection in “all but those rare situations in which a prospective purchaser is negotiating with two . . . dealers at the same time.” 55 Id. at 182 (Stevens, J., dissenting). He viewed Reeder and other dealers as valid competitors who dealt with the same Volvo trucks “in a single, interstate retail market.” 56 Id. at 185–86. Moreover, by distinguishing other instances in which Volvo charged Reeder higher prices than those it charged to competing dealers as “wholly discrete events” based on the identity of the customers, Justice Ginsburg, in his view, “ignor[ed] the fact that competition among truck dealers is a continuing war waged over time.” 57 Id. at 186. Justice Stevens and other commentators have argued that the majority approach effectively restricts RPA liability in competitive bidding situations, shielding liability for manufacturers. 58 See id. at 187 (“The Court appears to hold that, absent head-to-head bidding with a favored dealer, a dealer in a competitive bidding market can suffer no competitive injury.”); Rodell, supra note 52, at 973–74.

The Volvo opinion, nevertheless, left plenty of ammunition for RPA advocates to leverage. 59 See, e.g., Kirkwood, supra note 27, at 351 (“[T]he Court’s decision does not appear to jettison any of the basic protectionist features of the Act.”); Jeremy M. Suhr, Note, Reading Too Much Into Reeder-Simco?, 106 Mich. L. Rev. 169, 183–84 (2007) (arguing that the Volvo decision did not diminish lower courts’ application of the Morton Salt inference in secondary-line RPA cases in the first year). Justice Ginsburg notably did not require a showing of harm to competition to establish second-line injury, which is required under the consumer-welfare standard applied in Brooke Group. 60 See Volvo, 546 U.S. at 177 (“A hallmark of requisite competitive injury . . . is the diversion of sales or profits from a disfavored purchaser to a favored purchaser.”). Justice Ginsburg thereby expressly reaffirmed the Morton Salt doctrine. 61 See id. (“We have also recognized that a permissible inference of competitive injury may arise from evidence that a favored competitor received a significant price reduction over a substantial period of time.”). The continued existence of this powerful presumption means that plaintiffs can win an RPA claim even if the wholesaler’s discriminatory conduct has the overall effect of lowering prices for end consumers. Finally, by focusing the discussion in Volvo on whether Reeder and other Volvo dealers were “functional competitors” rather than whether they dealt with a “sale of goods” under the RPA, Justice Ginsburg left open the possibility that the RPA may apply to competitive bidding or other business transactions that arguably fall somewhere between a “sale” transaction and a “competitive bidding” contest. 62 See id. at 180–81. She stated that the Court’s decision to hold against Reeder does not answer the question of law about whether the RPA “reach[es] markets characterized by competitive bidding and special-order sales, as opposed to sales from inventory.” 63 Id. at 180 (“Volvo and the United States argue [that] the Act does not reach markets characterized by competitive bidding and special-order sales, as opposed to sales from inventory. We need not decide that question today.”). The majority opinion does not completely foreclose the possibility of finding RPA liability in other novel business contexts (i.e., in digital markets) where the occurrence of a “sale of good” may be unclear. 64 But see Kirkwood, supra note 27, at 352 (“Relying on the statutory language, most commentators state that a secondary-line price discrimination violation requires two sales—one at a higher price and one at a lower price—to competing resellers.”).

Furthermore, all nine Supreme Court justices who reviewed Volvo—Ginsburg, Roberts, O’Connor, Scalia, Kennedy, Souter, and Breyer in the majority; and Stevens and Thomas in the minority—were in alignment regarding the congressional intent behind the RPA. 65 See Volvo, 546 U.S. at 176; id. at 187 (Stevens, J., dissenting). In the Volvo dissent, Justice Stevens agreed with the majority that the RPA was primarily intended to “protect small retailers from vigorous competition afforded by chain stores and other large volume purchasers.” 66 Id. at 187–88 (noting that, even if Justice Stevens himself accepts Judge Bork’s characterization of the RPA as “wholly mistaken economic theory,” the Court must “adhere to the text of the Act”). He further argued that the Court, as a “faithful agent” of Congress, should find a violation under the RPA, given that the jury had found a reasonable possibility that discriminatory pricing may have harmed competition between Reeder and the other dealers. He stressed that the Court’s analysis should not be altered by the potential soundness of Judge Robert Bork’s critique that Volvo’s strategy may have procompetitive benefits. 67 See id. at 187–88.

Although the Court has incrementally narrowed the gap between the RPA and the other federal antitrust laws by imposing heightened evidentiary requirements, it has maintained that the RPA was designed to tackle the inequity arising from small independent stores’ “hopeless competitive disadvantage” compared to large purchasers. 68 Fed. Trade Comm’n v. Simplicity Pattern Co., 360 U.S. 55, 69 (1959). As such, the RPA continues to provide a means for smaller retailers today to seek relief against aggressive competition by large retailers.

II. A Potential Claim of Secondary-Line Antitrust Injury Against Amazon

How would one establish that Amazon has caused second-line injury? This Part explores the types of evidence that a reviewing court may consider in finding a successful RPA claim against Amazon as a retailer. The aim is not to provide a comprehensive checklist but rather to offer an overview of the key grounds on which litigating parties may win or lose based on case-specific facts. The hope is that this analysis will enable enforcers, private plaintiffs, and large retailers to better identify situations where the RPA may trigger liability to either reign in—or for Amazon to take necessary precautions not to engage in—problematic behavior.

Wherever a concrete example would be helpful, the analysis draws on Amazon’s position in the protein powder market to build a hypothetical case. As of 2016, Amazon was responsible for 57% of all protein powder purchases online. 69 Judie Bizzozero, Amazon Now a Key Player in the Health & Wellness Sector, Nat. Prods. Insider (Oct. 26, 2017), https://www.naturalproductsinsider.com/healthy-living/amazon-now-key-player-health-wellness-sector [https://perma.cc/F9BR-AYX3]. Amazon is a retail outlet for wholesalers like Optimum Nutrition that manufacture and sell numerous brands of protein powders. 70 Optimum Nutrition Store, Amazon, https://www.amazon.com/stores/OPTIMUMNUTRITION/OPTIMUMNUTRITION/page/E7F66C6A-49C9-4712-9DA5-9485E3BB3BA3 [https://perma.cc/KY7P-94YL] (last visited Sept. 19, 2021). Optimum Nutrition sells these same protein powders through other online retailers, including Bodybuilding.com, Vitamin Shoppe, and GNC, as well as brick-and-mortar stores. 71 Id. Amazon, like the other retailers, individually negotiates with suppliers to purchase its protein powder at favorable wholesale prices to then resell. 72 Amazon.com, Inc., 2020 Annual Report 19 (2021), https://s2.q4cdn.com/299287126/files/doc_financials/2021/ar/Amazon-2020-Annual-Report.pdf [https://perma.cc/K98P-TKX6] [hereinafter Amazon, 2020 Annual Report] (“The products offered through our stores include merchandise and content we have purchased for resale and products offered by third-party sellers . . . .” (emphasis added)); cf. How Are eBay and Amazon Different?, Investopedia (Aug. 30, 2021), https://www.investopedia.com/articles/investing/061215/how-are-ebay-and-amazon-different.asp [https://perma.cc/YAE5-P8RW] (“Amazon is more buyer-oriented, actively inviting buyers to visit the site to browse through and subsequently purchase the inventory listed on the site, as one would in a traditional retail store.”). A situation ripe for a potential RPA claim would be where a small brick-and-mortar health and fitness products retailer sees a sustained price differential between what it pays as a wholesale price to Optimum Nutrition and what Amazon pays as a wholesale price for the same Optimum Nutrition products. This small retailer could bring an RPA case against both Optimum Nutrition and Amazon, arguing that Amazon is wielding its strong purchasing power to extract lower prices from the wholesaler, Optimum Nutrition, to the detriment of the small retailer.

It is important to note that the appropriate grounds to make this argument would be Amazon’s retail business with wholesalers or first-party sellers—not its marketplace for third-party sellers. Amazon offers two different programs for vendors to have their products featured on www.amazon.com: Amazon Seller Central and Amazon Vendor Central. 73 Alex Knight, Amazon Vendor Central: Everything You Need to Know, WebRetailer, https://www.webretailer.com/b/amazon-vendor-central/ [https://perma.cc/7ERG-4DBC] (last visited Oct. 1, 2021); Brij Purohit, Amazon Vendor Central: What’s New—2020 Update, SellerApp, https://www.sellerapp.com/blog/amazon-vendor-central-pricing/ [https://perma.cc/8GBU-9N77] (last visited Aug. 18, 2021). Under Amazon Seller Central, vendors can sell directly to shoppers as a third-party seller. 74 Knight, supra note 73. Sellers have control over the retail process, setting retail prices, listing products, fulfilling and shipping orders (unless they pay extra for Fulfillment by Amazon (FBA)), and dealing with customer support issues. 75 The Beginner’s Guide to Selling on Amazon, Amazon, https://sell.amazon.com/beginners-guide.html [https://perma.cc/DT83-88LV] (last visited Aug. 18, 2021). For every completed sales transaction, a third-party seller takes the profit margin between its retail price and cost of the good, after paying Amazon a commission fee. 76 Purohit, supra note 73. Under Amazon Vendor Central, vendors (which are allowed to join on an invitation-only basis) sell directly to Amazon in set quantities at wholesale prices, taking the profit margin between the wholesale price and the cost of the good. 77 Knight, supra note 73. Amazon Retail then resells those products to shoppers at retail prices. In sum, Amazon Seller Central has a self-service business model in which Amazon acts as an intermediary between the third-party seller and the shoppers, whereas Amazon Vendor Central has a traditional wholesale-distribution model. 78 Id.; JungleScout, The State of the Amazon Seller 2020, at 1, 9 (2020), https://www.junglescout.com/wp-content/uploads/2020/02/State-of-the-Seller-Survey.pdf [https://perma.cc/2MMH-TPVN].

While Amazon’s third-party sales account for a greater share of the physical gross merchandise sold on the Amazon marketplace (58% in 2018 79 Jeff Bezos, 2018 Letter to Shareholders, Amazon (Apr. 11, 2019), https://www.aboutamazon.com/news/company-news/2018-letter-to-shareholders [https://perma.cc/J627-P73K] (explaining that Amazon’s third-party sales as a percentage of the physical gross merchandise sales sold on the marketplace has grown from 3% to 58% between 1999 and 2018). ), Amazon’s first-party sales continue to be the driving force behind its colossal revenue. 80 See Don Davis, Amazon’s Profits Nearly Triple in Q3 as North America Sales Soar 39%, DigitalCommerce360 (Oct. 29, 2020), https://www.digitalcommerce360.com/2020/10/29/amazons-profits-nearly-triple-in-q3-as-north-america-sales-soar-39-2/ [https://perma.cc/W6LN-83VE]. In the third quarter of 2020, during the COVID-19 pandemic, Amazon’s merchandise of its own goods reached $52.77 billion, and its commission fees from third-party sales reached $43.27 billion. 81 See id. (indicating that $52.77 billion or 54% of its net sales revenue was from “merchandise Amazon itself sold to consumers,” but this may also include sales figures of Amazon’s private label products as well as resold wholesale goods). Given that the paradigm RPA case is one in which the plaintiff and the defendant are in a wholesaler–distributor relationship, the following analysis focuses on Amazon’s role as a distributor for its first-party sellers. All references to “Amazon,” unless specified otherwise, indicates Amazon Retail as a reseller for its first-party sellers.

The following sections examine specific elements to a substantive RPA claim: A plaintiff must show that (1) a seller is charging competing buyers different prices for “commodities of like grade and quality” and (2) that there is “competitive injury.” Defendants may assert a number of affirmative defenses in response.

A. “Commodities of Like Grade and Quality”

First, the RPA bars price discrimination between different purchasers of “commodities of like grade and quality.” 82 15 U.S.C. § 13(a) (2018). The RPA has been generally interpreted to apply to purchases of commodities but not to services, leases, real estate, intellectual property, or other intangibles. 83 See Williams v. Duke Energy Int’l, Inc., 681 F.3d 788, 800 (6th Cir. 2012) (finding that electricity qualifies as a “commodity” where it could be “produced, sold, stored in small quantities, transmitted, and distributed in discrete quantities” for resale to customers). If a sale involves a mixture of goods and services, some circuits require that the “dominant nature” of the business be in the resale of products for the RPA to apply. 84 See Metro Commc’ns Co. v. Ameritech Mobile Commc’ns, Inc., 984 F.2d 739, 745 (6th Cir. 1993) (“This court has ruled that the Robinson–Patman Act is applicable to transactions that involve the sale of both goods and services only if the ‘dominant nature’ of the transaction is a sale of goods.”).

A plaintiff would want to stress that Amazon is functionally like any other chain store: It acts as a reseller of “commodities” purchased from its first-party sellers. Amazon may oppose this characterization and argue instead that it sells a bundle of services—including app-based means of search, Alexa-enabled search, guarantee of quick delivery services, and reliable customer service, among others. 85 See Amazon.com, Inc., Annual Report (Form 10-K) (Jan. 31, 2020), https://www.sec.gov/Archives/edgar/data/0001018724/000101872420000004/amzn-20191231x10k.htm [https://perma.cc/7F2A-7Q7P] [hereinafter Amazon 10-K] (“We serve consumers through our online and physical stores and focus on selection, price, and convenience.”). A plaintiff would want to argue that, under the dominant nature test, (1) a sale transaction in the Amazon marketplace predominantly involves the transfer of a product and (2) that any intangible services offered are incidental to the transfer of the product. 86 See Innomed Labs, LLC v. ALZA Corp., 368 F.3d 148, 158 (2d Cir. 2004) (finding that a contract selling a commodity with the appended right to distribute the commodity exclusively was still within the “ambit of the Robinson–Patman Act”); Metro Commc’ns Co., 984 F.2d at 745 (holding that the “dominant nature” test is not applicable where the transaction only involves a commission paid for the marketing of activation service, which was sold separately from telephones).

Even if Amazon does sell “commodities” like other retailers, Amazon may argue that its host of services alter the “grade and quality” of its products. For instance, additional services that Amazon Prime shoppers could take advantage of by purchasing on the Amazon Marketplace could arguably alter the demand for the same commodity. 87 About Amazon Prime Insider and Prime Membership Benefits, Amazon, https://www.amazon.com/primeinsider/about [https://perma.cc/9SDL-PNQF] (last visited Aug. 17, 2021). Amazon Prime, Amazon’s paid subscription program, gives users access to same-day, one-day, or two-day delivery; exclusive video content; and discounts at Whole Foods Market, among other services otherwise unavailable or available at a premium to regular Amazon customers. 88 Id. If the products sold by the two parties are physically identical, the Supreme Court has held that the difference in “economic factors,” like labeling, packaging, and branding, cannot defeat the “like grade and quality” element. 89 See Fed. Trade Comm’n v. Borden Co., 383 U.S. 637, 645–46 (1966) (“[T]he economic factors inherent in brand names and national advertising should not be considered in the jurisdictional inquiry under the statutory ‘like grade and quality test.’” (quoting Report of the Attorney General’s National Committee to Study the Antitrust Laws 158 (1955))).

Would the speed of delivery that Amazon offers count as such an “economic factor” that makes no difference? Whereas branding and advertising may not change the underlying functionality of the physical product, significant difference in timing of delivery—a consumer’s ability to consume the good at a particular time window—could arguably alter its underlying value (e.g., seasonal goods like Halloween costumes). The strength of this argument could depend on the degree to which the delivery service provided by the plaintiff dealer differs from that offered by Amazon. A marginal increase in convenience due to hastened delivery may not show a difference in “grade and quality,” whereas considerable difference in delivery, based on industry-specific standards, may provide grounds for Amazon to argue that the sales are not comparable transactions. 90 See Aerotec Int’l, Inc. v. Honeywell Int’l, Inc., 836 F.3d 1171, 1187–88 (9th Cir. 2016) (finding that, while the buyers dealt with the same commodity, the “only pricing discrepancy between independent servicers and [the defendant’s] affiliates . . . is attributable to the benefits received by [the defendant] through long-term agreements”).

A court might consider this element a nonissue altogether. In one recent RPA case involving the sale of furniture through a brick-and-mortar retailer and Wayfair.com, the District Court of Nevada did not question whether the furniture sold at the two venues manufactured by the same company were commodities of “like grade and quality.” 91 See Furniture Royal, Inc. v. Schnadig Int’l Corp., No. 2:18-CV-318 JCM (CWH), 2018 WL 6574779, at *1, 3 (D. Nev. Dec. 13, 2018). The court took as a given that Wayfair, a national online furniture retailer, and a small local brick-and-mortar store were selling the same “commodity.” 92 See id. at *3. The court focused its attention on whether the two establishments were competing purchasers. 93 See id. While Wayfair is not as diversified in its offering of products and services as Amazon is, the fact that an e-commerce retailer and a brick-and-mortar retailer were considered to be providing the same commodity in this district court case bodes well for potential plaintiffs. Considering this element, a plaintiff would reduce the risk of dismissal for a failure to state a claim by identifying a tangible product that is supplied by the same wholesaler on both its platform and Amazon.

B. Competitive Injury

To establish a prima facie violation of the RPA, the plaintiff must show a reasonable possibility that a price difference may harm competition. 94 Corn Prods. Refin. Co. v. Fed. Trade Comm’n, 324 U.S. 726, 742 (1945). Unlike the Sherman Act, which requires proof of actual harm to competition, the RPA only requires that a plaintiff establish a “reasonable inference” that the discrimination caused “competitive injury.” 95 J. Truett Payne Co. v. Chrysler Motors Corp., 451 U.S. 557, 562–66, 564–65 n.4 (1981). Direct evidence of sales or profits diverted from a disfavored purchaser to a favored purchaser could show competitive injury. 96 See Volvo Trucks N. Am., Inc. v. Reeder-Simco GMC, Inc., 546 U.S. 164, 177 (2006); Falls City Indus., Inc. v. Vanco Beverage, Inc., 460 U.S. 428, 437–38 (1983). Indirect evidence of a prolonged and substantial difference in price between competing purchasers could also establish a rebuttable presumption that competition has been injured. 97 See Volvo, 546 U.S. at 177; Fed. Trade Comm’n v. Morton Salt, 334 U.S. 37, 49–51 (1948). As Part I discusses, Justice Ginsburg in Volvo reaffirmed the validity of this presumption under the Morton Salt doctrine. 98 See Volvo, 546 U.S. at 177 (“We have also recognized that a permissible inference of competitive injury may arise from evidence that a favored competitor received a significant price reduction over a substantial period of time.” (citing Falls City Indus., 460 U.S. at 435; Morton Salt, 334 U.S. at 49–51)). Unless the defendant successfully raises one of the RPA affirmative defenses, a showing of “competitive injury” suffices to support injunctive relief or treble damages for a private plaintiff under section 4 of the Clayton Act. 99 Falls City Indus., 460 U.S. at 435.

The following sections examine the subelements of competitive injury in turn: (1) that the seller charged different prices to “competing purchasers,” (2) that the price differential was “prolonged and substantial,” and (3) that this price discrimination caused actual injury (lost profits) to the plaintiff.

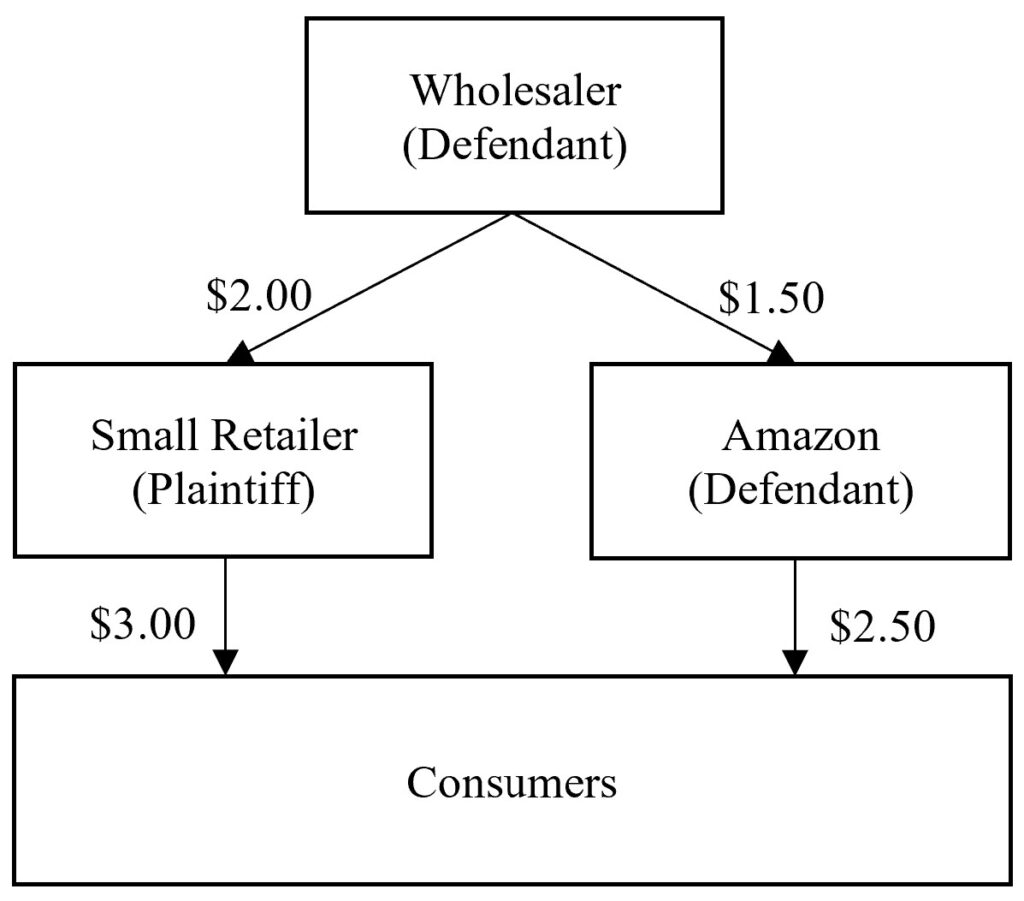

1. Competing Purchaser Requirement. — “Competitive injury” under the RPA is established by proof of “substantial price discrimination between competing purchasers over time.” 100 Freesers, Inc. v. Michael Foods, Inc., 498 F.3d 206, 213 (3d Cir. 2007) (quoting Falls City Indus., 460 U.S. at 435). The purchasers must have been competing head-to-head for sales to the same customer. 101 See Volvo, 546 U.S. at 179–81. In a case against Amazon, a plaintiff would need to show that it competed with Amazon as purchasers—that the two companies were at the “same functional level of distribution.” 102 16 C.F.R. § 240.5 (2016) [hereinafter Fred Meyer Guides] (“Competing customers are all businesses that compete in the resale of the seller’s products of like grade and quality at the same functional level of distribution regardless of whether they purchase directly from the seller or through some intermediary.”). Figure 1 below illustrates the relationship between competing purchasers to establish secondary-line injury.

Figure 1: “Competing Purchasers” in Secondary-Line Injury Case

Any evidence that the plaintiff dealer competes with Amazon to resell to the same customers would help satisfy this element. For an online fitness products e-retailer, for example, testimony from its customers that they compare the prices of protein powder products on its platform and Amazon would help. An e-retailer could leverage its web analytics to show that customers who browse and purchase protein powder products on its platform share similar demographic features as shoppers of those products on Amazon. Such proxy measures could show that the e-retailer shares a significant overlapping customer base with Amazon to satisfy this element.

A brick-and-mortar retailer could similarly offer evidence that customers who visit the establishment in-person also routinely browse the Amazon app or website on their mobile devices to compare prices. 103 See Gary Lee, Why 90 Percent of Sales Still Happen in Brick and Mortar Stores, Retail Tech. Rev. (Oct. 17, 2017), https://www.retailtechnologyreview.com/articles/2017/10/17/why-90-percent-of-sales-still-happen-in-brick-and-mortar-stores/ [https://perma.cc/6KLP-L5WE] (noting that 90% of in-store shoppers use their mobile devices to search for coupons, check product descriptions, reviews, and pricing online). Even if a physical store is constrained to operating in a specific geographic market, plaintiffs should have little difficulty in arguing that Amazon, with its national presence, is also accessible to local customers. In Furniture Royal, Inc. v. Schnadig Int’l Corp., the district court case in Nevada, a brick-and-mortar furniture store called Furniture Royal sued the furniture manufacturer Schnadig under the RPA, arguing that Schnadig engaged in discriminatory pricing. 104 No. 2:18-CV-318 JCM (CWH), 2018 WL 6574779, at *1, 3 (D. Nev. Dec. 13, 2018). Furniture Royal had been selling Schnadig’s furniture since 2010. 105 Id. at *1. Then, in 2016, Schnadig entered into an agreement with Wayfair to sell its furniture directly to consumers on Wayfair’s customers. 106 Id. Schnadig sold its furniture on Wayfair.com at below retail prices—up to 40% off in some cases. 107 Id. Furniture Royal argued that the below-retail prices on Wayfair rendered the brick-and-mortar store an “Exhibit Room” where consumers could see the furniture in-person and then purchase off of Wayfair. 108 Id. The district court held against the plaintiff in this case where the manufacturer was selling directly to an “end-use consumer” rather than a “competing purchaser.” 109 Id. at *3 (“According to the complaint, Schnadig engaged in discriminatory pricing between Furniture Royal, which is a retailer, and end-use consumers.”). The court observed that, “[a]lthough consumers use these websites to purchase furniture, Wayfair does not maintain any tangible inventory . . . . Instead, Schnadig sends its products directly to the consumers, which renders the websites as advertising platforms.” 110 Id. at *1. The court thus refused to accept Wayfair as a retailer of Schnadig’s furniture in this context, where Schnadig, as a third-party seller on Wayfair’s platform, controlled the retail price of the furniture. 111 See id. at *3. In other words, the steep discount for the furniture on Wayfair’s website was not attributed to Wayfair’s purchasing power but rather to Schnadig’s ability to disintermediate middlemen and thereby charge below retail prices without sacrificing its margins.

The court’s discussion here highlights the importance of challenging a powerful e-commerce platform’s conduct via its pricing strategy as a first-party seller, rather than through the pricing strategy of its third-party sellers. In the latter scenario, the court would likely find that the RPA is inapplicable because the wholesaler price discriminates between retailers and ultimate consumers, and “retailers are not in competition with end-use consumers.” 112 Id. Similar to Wayfair, Amazon may not qualify as a small retailer’s “competing purchaser” in the context of a third-party seller transaction.

On the flip side, a small retailer would have a credible claim that Amazon Retail is a competing purchaser where Amazon is not merely an “advertising platform” but a purchaser of a supplier’s goods that resells the good at retail prices of its choice. 113 See id. at *1. This argument is supported by the fact that Amazon, as part of Amazon Vendor Central, does maintain a tangible inventory and pay negotiated wholesale prices. 114 Knight, supra note 73. By showing that Amazon is a reseller targeting the same end consumers as a smaller dealer (which is not in dispute in Furniture Local), a plaintiff may have a much higher probability of meeting the “competing purchaser” requirement. 115 Amazon itself stresses in its SEC 10-K Reports that its “potential competitors” include “physical, e-commerce, and omnichannel retailers, publishers, vendors, distributors, [and] manufacturers.” Amazon 10-K, supra note 85.

2. “Prolonged and Substantial” Price Differential. — Under the Morton Salt doctrine, “injury to competition” may be presumed if a favored competitor received “prolonged and substantially better” pricing. 116 Fed. Trade Comm’n v. Morton Salt, Co., 334 U.S. 37, 49–51 (1948); Vanco Beverages, Inc. v. Falls City Indus., Inc., 654 F.2d 1224, 1229 (7th Cir. 1981), rev’d, 460 U.S. 428, 436 (1983) (finding that the plaintiff did establish the Morton Salt inference where a wholesale beer manufacturer charged one distributor prices approximately 10% to 30% higher than it charged other distributors over a six-year period); Napleton’s Arlington Heights Motors, Inc. v. FCA US LLC, 214 F. Supp. 3d 675, 688 (N.D. Ill. 2016) (finding that the Morton Salt inference is established with $1,600 price difference for one year); Mathew Enter., Inc. v. Chrysler Grp. LLC, No. 13-cv-04236-BLF, 2016 WL 4269998, at *6–8 (N.D. Cal. Aug. 15, 2016) (finding that the Morton Salt inference is established with a 2.3% price difference over 11 months). Fleeting or de minimis price discrimination, by contrast, is insufficient to show injury. 117 See Falls City Indus., 460 U.S. at 435. A plaintiff should try first to establish competitive injury under the plaintiff-friendly Morton Salt inference, given that the plaintiff would otherwise have to engage in a detailed market analysis proving how a seller’s price discrimination injured competition. 118 See Am. Oil Co. v. Fed. Trade Comm’n, 325 F.2d 101, 104–06 (7th Cir. 1963) (holding that the FTC had not demonstrated an RPA violation because the record showed neither prolonged price discrimination nor evidence that the discrimination caused injury to competition).

Here, a smaller retailer plaintiff could establish the Morton Salt inference with proof that that Amazon persistently receives a steeper discount from the wholesaler. Given that there are no clear guidelines as to what magnitude qualifies as “substantial” and what length of time qualifies as sufficiently “prolonged,” 119 The FTC’s Fred Meyer Guides do not provide any definitions or explanations of these terms. See 16 C.F.R. § 240 (2020). the best way to establish the inference would be to amass sales transactions where the retailer and Amazon were competing head-to-head. As illustrated in Figure 2, proving a price differential at the wholesale level—showing, for instance, that the plaintiff was charged $2.00 per unit for the same protein powder for which Amazon was charged $1.50 per unit (25% discount)—is key. The RPA theoretically applies whether or not that differential was passed on to end-use consumers at the retail level.

Figure 2: Differential Pricing Among Competing Purchasers

For the purpose of comparing prices to show discrimination, there must have been actual sales, not prospective bids or terminated sales that were reasonably contemporaneous based on the time of contracting (similar to the “commodities of same grade and quality” requirement). 120 See Crossroads Cogeneration Corp. v. Orange & Rockland Utils., Inc., 159 F.3d 129, 142 (3d Cir. 1998) (finding that offering to sell electricity at a lower rate than a competitor is not price discrimination as this a speculative sale rather than an actual one). This is to account for the fact that prices of a good are subject to change over time. Here, the plaintiff could monitor retail prices and, to the extent possible, wholesale prices for reasonably contemporaneous sales of that product to show a prolonged and substantial price differential.

Given that the wholesale prices that Amazon negotiates with vendors are not public information, and discovery is unavailable at early stages of litigation, a potential plaintiff may have to rely on the magnitude of the retail price differential and insider testimony from the wholesaler. Plaintiffs would also need to engage economic experts at early stages of the litigation to establish the Morton Salt presumption. Estimating the price differential between the wholesaler’s price charged to favored versus disfavored buyers requires significant statistical analysis beyond the expertise of lawyers. While expert testimony costs are generally unavoidable, establishing the Morton Salt presumption would incur lower expert witness costs for the plaintiff than undertaking a thorough detailed market analysis of injury to competition or consumer harm. 121 See supra section II.B.2.

3. Diversion of Sales or Profits From a Disfavored Purchaser to a Favored Purchaser. — A plaintiff seeking damages for an RPA violation has a higher burden of showing “antitrust injury” under section 4 of the Clayton Act, which the Supreme Court has defined as lost profits or sales to the plaintiff caused by price discrimination. 122 See J. Truett Payne Co. v. Chrysler Motors Corp., 451 U.S. 557, 564 n.4 (1981) (noting that the Court had previously defined antitrust injury to include “the extent of the . . . profits” that are diverted “by reason of the discrimination” (quoting Interstate Com. Comm’n v. United States, 289 U.S. 385, 390–91 (1933))). To show lost profits from price discrimination, the plaintiff has to (1) establish the price it would have paid but for the price discrimination, then (2) show that, as a disfavored buyer that was charged a higher price, it lost business to the defendant. 123 Glick et al., supra note 9, at 307–08. The defendant, meanwhile, would try to break the causal connection between the price differential and the plaintiff’s lost sales or profits.

Estimating a “but-for” price under hypothetical circumstances necessarily requires fact-intensive economic analysis. Here, a plaintiff would argue that the plaintiff and Amazon are close competitors that have a high cross-elasticity of demand. 124 See id. at 308. The higher the cross-elasticity, the more the retail prices of the favored buyer (Amazon) would impact the sales or profits of the disfavored buyer (small retailer). 125 See id. A plaintiff would stress that because consumers can access Amazon from any smartphone, they incur low costs switching between Amazon and a competing physical or online store.

A plaintiff need not produce one single price estimate to establish a reasonable “but-for price.” The Ninth Circuit’s decision in Hasbrouck v. Texaco, Inc., suggests that presenting several possible “but-for” price estimates is sufficient. 126 See Hasbrouck v. Texaco, Inc., 842 F.2d 1034, 1043–44 (9th Cir. 1987), aff’d, 496 U.S. 543 (1990) (explaining that, “[i]n an attempt to estimate lost sales resulting from Texaco’s pricing differentials, Hasbrouck’s expert presented a market analysis that compared Hasbrouck’s actual prices, volume and profits to its estimated amounts had the price discrimination not occurred” and holding that Hasbrouck made a sufficient showing). The plaintiffs in Hasbrouck commissioned an expert witness who made six economic projections of possible but-for prices. 127 See id. at 1043. The Ninth Circuit held that, where the “various projections . . . permit[] the jury to compare estimates of damages in different market situations, allowing them to determine what [the plaintiff’s] sales and profits would have been in the absence of price discrimination,” the projections can properly be included in evidence. 128 Id. at 1043–44. In response, Amazon might try to argue that the plaintiff has the burden to establish the “but-for” price with a high degree of certainty, especially where the plaintiff may have reasons for its underperformance even in the absence of price discounts to Amazon. But to raise the likelihood of success, the plaintiffs could put forth through multiple economic projections that they suffered lost profits due to the Amazon-induced seller price discrimination.

4. Seller or Favored Buyer’s Market Power. — Courts have started limiting the Morton Salt inference to situations in which either the buyer or the seller has market power. 129 The economic reasoning is that a firm without market power would not be able to induce a wholesaler to price discriminate against certain disfavored sellers in the first place. A buyer with high market share may be able to negotiate a discounted price given its importance as a valuable client to the wholesaler, whereas a buyer with low market share would likely be unable to. See, e.g., In re Brand Name Prescription Drugs, 186 F.3d 781, 785 (7th Cir. 1999) (explaining that, to show collusion, plaintiffs needed direct evidence of agreements to collude or circumstantial evidence that the defendant manufacturers were exploiting their market power). As Judge Posner noted in his opinion in In re Brand Name Prescription Drugs, the ability of a company to price discriminate between its dealers implies some market power. 130 Id. at 786. A showing of the favored dealer’s buying power is not required, but Justice Ginsburg in Volvo made clear that Congress was most concerned with buyer-induced price discrimination by large chain stores. 131 See Volvo Trucks N. Am., Inc. v. Reeder-Simco GMC, Inc., 546 U.S. 164, 181 (2006) (“[T]here is no evidence here that any favored purchaser possesses market power[;] the allegedly favored purchasers are dealers with little resemblance to large independent department stores or chain operations . . . .”).

Here, a small retailer plaintiff would have a convincing claim that Amazon has great buying power and that the wholesaler also has selling power, albeit to a lesser extent. During June 2021, Amazon.com had over 2.7 billion desktop and mobile visits, making it the most visited e-commerce platform in the United States by a huge margin. 132 Worldwide Visits to Amazon.com From January to June 2021, Statista (Aug. 10, 2021), https://www.statista.com/statistics/623566/web-visits-to-amazoncom/ [https://perma.cc/33W7-T4JM]. Amazon now has more than 200 million Amazon Prime members worldwide. 133 Amazon, 2020 Annual Report, supra note 72. Amazon could easily leverage the incentive (or threat) of gaining (or losing) access to its massive traffic to negotiate lower wholesale prices for Amazon. Because Amazon allows vendors to join Amazon Vendor Central by invite only, the wholesalers on Vendor Central likely have a reputable brand or prior history of success on Amazon. 134 Knight, supra note 73 (noting that Amazon sends invites to “existing brands with strong demand from Amazon shoppers,” “marketplace sellers who are doing exceptionally well with their own products,” and “exhibitors at trade shows and fairs with attractive products”). Amazon could hone in on this factor to argue that its wholesalers often do have negotiating power at the table. But the loss of Amazon as a retailer would arguably injure a wholesaler more than the loss of any given wholesaler would injure Amazon. Once a plaintiff establishes Amazon’s market power, it could more easily claim that Amazon had the ability to extract lower prices from wholesalers—that is, prices below what wholesalers would usually be willing to charge or could afford to charge other retailers.

5. Consumer Harm. — As Part I notes, the Volvo Court did not adopt a consumer harm requirement to find RPA liability. In theory, a plaintiff need not show that a price discrimination scheme increased prices to the end-use consumer. 135 See Volvo, 546 U.S. at 176 (noting that “injur[ies] to competition at the level of the purchaser’s customers, i.e., tertiary-line cases, comprise only one of three “categories of competitive injury that may give rise to a[n] [RPA] claim”). But Justice Ginsburg’s dictum that “interbrand competition” is still the primary goal of antitrust laws 136 Id. at 180. will likely animate defendants to argue that the defendant’s conduct enhances interbrand competition. A plaintiff should therefore still be prepared to counter questions about the price discrimination’s effect on consumer welfare to bolster its RPA claim.

Here, while Amazon could provide consumers with lower prices in the short run, the plaintiff will argue that Amazon-induced wholesaler price discrimination takes business and profits from independent sellers, reducing their number and vigor. Eliminating smaller establishments would eventually deprive consumers of the convenient locations, distinctive services, superior selection, and other attractive features that the independent dealers would have offered. 137 See, e.g., John B. Kirkwood, Reforming the Robinson-Patman Act to Serve Consumers and Control Powerful Buyers, 60 Antitrust Bull. 358, 370 (2015) (explaining how these features of small establishments, at least in the context of bookstores, are appealing to consumers). If consumers who value those features lose more than other consumers gain from the lower prices (or other enhanced offerings) offered by Amazon, the non-cost-justified discrimination would reduce consumer welfare. 138 See, e.g., id. (“[I]f Amazon continues . . . using its buyer power . . . to grow at the expense of brick-and-mortar booksellers[,] it could reduce overall consumer welfare.”). For a greater chance of success, a plaintiff or enforcement agency could argue on both legal and economic grounds that applying the RPA to Amazon’s pricing practices would not only comport with the Act’s legislative intent, but also further the goals of competition.

C. Defenses

In reality, plaintiffs often fail on the competitive injury element, given that a defendant can overcome the Morton Salt inference by raising two powerful affirmative defenses: (1) that the price difference was justified by different costs in manufacture, sale, or delivery (the “cost-justification” defense); or (2) that the price difference was a concession given in good faith to meet a competitor’s price (the “meeting-competition” defense). 139 See Texaco Inc. v. Hasbrouck, 496 U.S. 543, 555–56 (1990) (citing Standard Oil Co. v. Fed. Trade Comm’n, 340 U.S. 231, 250 (1951)).

1. Cost-Justification Defense. — To make the cost-justification defense, the defendants must prove that the price differential is justified by cost differences arising from differing methods or quantities in which the commodities are sold or delivered. 140 Section 2(a) of the RPA provides that a seller may “make . . . due allowance for differences in the cost of manufacture, sale, or delivery resulting from the differing methods or quantities . . . sold” to different customers. 15 U.S.C. § 13(a) (2018). Cost differences may arise from differences in manufacturing, freight and delivery, methods of sale, and legal compliance. 141 Glick et al., supra note 9, at 287. This defense, embedded in the text of the RPA, was Congress’s attempt to promote legitimate cost efficiencies attributable to scale, while taking the antimonopolist stance that larger buyers should not receive more favorable pricing merely because of their market power. 142 Id. at 286.

Here, the wholesaler defendant must show that its price concessions to Amazon match the actual cost differences between the method of delivery or sale offered by Amazon and the methods offered by other retailers. That is, the wholesaler (e.g., Optimum Nutrition) would have to show that its cost savings by going with Amazon explains the difference between what it charges Amazon for its protein powder and what it charges a smaller retailer. Such savings would be calculated on the basis of the costs avoided by the wholesaler in shipping and selling to Amazon, not the costs incurred by Amazon in providing delivery and other additional services. 143 See id. at 286–87 (citing Texaco, 496 U.S. at 564). The wholesaler may argue that it avoids higher delivery costs by delivering through Amazon’s unparalleled distribution network.

Merely asserting saved costs without supporting evidence, however, would not suffice. For instance, the Seventh Circuit in Mueller Co. v. FTC rejected the seller’s argument that the favored buyer reduced inventory costs by warehousing the seller’s products, as the favored buyer also received the discount on transactions when not performing the warehousing function for the seller. 144 See Mueller Co. v. Fed. Trade Comm’n, 323 F.2d 44, 47 (7th Cir. 1963). This means that the seller and Amazon would have to substantiate the asserted link between the seller’s cost savings and the discounts awarded to Amazon. 145 See id. (holding that mere speculation that the seller incurred extra handling costs was insufficient to establish the defense). The court would query which group of consumers the seller (like Optimum Nutrition) meant to target and what expenses the seller ended up saving to target those customers by going with Amazon. Connecting the associated cost savings to the discounts is an undertaking that would require economic experts. The success of this defense would ultimately hinge on how the wholesaler categorizes its customers and attributes cost savings to those particular groups. The plaintiffs would want to critically examine and identify any issues with the methodology used by Amazon to draw the connection between cost savings to targeted groups of consumers. For instance, if Amazon uses a method that does not fully disaggregate its profits from cloud computing division Amazon Web Services (AWS) or other services that do not directly provide a cost saving to retail wholesalers, 146 Some critics have suggested that Amazon has been using its high profits from Amazon Web Services to cross-subsidize losses in its retail division. See, e.g., Lina M. Khan, Note, Amazon’s Antitrust Paradox, 126 Yale L.J. 710, 747 (2017). the courts may find the link insufficient to establish Amazon’s RPA cost-justification defense.

2. Meeting Competition Defense. The wholesaler defendant could also raise the “meeting-competition” defense by showing that the wholesaler lowered prices in “good faith” to meet—but not beat—the lower price of a competitor offered to the same customer. 147 15 U.S.C. § 13(b) (2018). The “good faith” requirement is “flexible and pragmatic, not a technical or doctrinaire, concept.” Continental Banking Co., 63 F.T.C. 2071, 2163 (1963) (opinion of the Commission); see also Falls City Indus., Inc. v. Vanco Beverage Inc., 460 U.S. 428, 445–46 (1983) (“[T]he defense requires that the seller offer the lower price in good faith for the purpose of meeting the competitor’s price, that is, the lower price must actually have been a good faith response to that competing low price.” (citing Frederick M. Rowe, Price Discrimination Under the Robinson–Patman Act 234–35 (1962))). Notably, it is insufficient to merely have vague claims to lower prices to prevent “lost sales.” A wholesaler discriminating in favor of one customer must show that it is offering this lower price to prevent losing that sale to a specifically identified competitor. 148 See Falls City Indus., 460 U.S. at 445. The wholesaler like Optimum Nutrition may argue that identified protein powder sellers began to sell at lower prices on the Amazon marketplace and, as a result, it had to take Amazon’s request for reduced wholesale prices in order to stay competitive. (Note that this is logically consistent with the reasoning under the “competing purchaser” requirement, in which Amazon Retail is a competitor of the plaintiff retailer.) To determine whether Optimum Nutrition’s conduct was indeed in “good faith,” a reviewing court would consider whether it (1) received reports of similar discounts from customers; (2) was threatened with termination of purchases if the discount was not met; (3) made efforts to corroborate the reported discount; and (4) had past experiences with the buyer. 149 Reserve Supply Corp. v. Owens-Corning Fiberglass Corp., 971 F.2d 37, 42 (7th Cir. 1992). In this instance, third-party sellers of protein products on Amazon would indeed be “competitors” of Optimum Nutrition. Given the aggressive price cutting by foreign suppliers and arbitragers on the Amazon Marketplace and the transparency of those prices, wholesalers like Optimum Nutrition may have a high chance of establishing this defense. Amazon could also piggyback off of the wholesaler defendant’s “meeting competition” defense and argue that the wholesaler was responding to its competitors rather than Amazon’s heavy-handed demand for a discount. Thus, both the wholesaler defendant and Amazon could rely on this argument.

In response to this defense, a plaintiff could stress the fact that the other wholesalers selling on Amazon (i.e., competitors of Optimum Nutrition) are similarly being squeezed to give lower wholesale prices. While this reasoning would not wholly negate the meeting competition defense, it would shift the focus from the competition among protein powder sellers to Amazon’s overwhelming market power as a distribution channel for protein powders. The plaintiff would argue that the latter is the bigger driver of the price differential between protein powder wholesale prices charged to Amazon versus the small retailer plaintiff.

In sum, the meeting competition defense would likely be the toughest hurdle for the plaintiff to overcome. The fact that many wholesalers compete on the Amazon marketplace platform would work to Amazon’s advantage. But this fact could be leveraged to highlight the monopoly power that Amazon possesses, which enables it to induce price discrimination by wholesalers that is barred under the RPA.

Conclusion

This exercise of applying the RPA to Amazon attempts to show how plaintiffs and government agencies could bring a secondary-line case against the giant e-retailer. Given that the e‑retailer still retains the traditional wholesaler-distributor model as a part of its business, building a prima facie RPA case would not be difficult. A seller on Amazon, however, would have strong affirmative defenses, given its legitimate size-based efficiencies and competitive pressures from third-party sellers on its own marketplace platform. This exercise thus demonstrates that the RPA is an available tool for antitrust enforcers, albeit blunted with the heightened evidentiary standards for finding competitive injury and strong affirmative defenses available.

Today, public recognition of Big Tech’s dominance in various markets has fueled momentum for stronger antitrust enforcement, even beyond the RPA and other existing antitrust laws. By the end of 2020, various U.S. federal agencies and state attorneys general had launched antitrust investigations against Apple, Amazon, Facebook, and Google. 150 Factbox: How Big Tech Is Faring Against U.S. Lawsuits and Probes, Reuters (July 13, 2021), https://www.reuters.com/technology/big-tech-wins-two-battles-fight-with-us-antitrust-enforcers-2021-06-29/ [https://perma.cc/3AYB-C2UL]. The Biden Administration signaled willingness to prosecute antitrust violations more aggressively by appointing Lina Khan, a progressive antitrust scholar, as FTC chair. 151 Press Release, Lina M. Khan Sworn in as Chair of the FTC, FTC (June 15, 2021), https://www.ftc.gov/news-events/press-releases/2021/06/lina-khan-sworn-chair-ftc [https://perma.cc/6NNE-YPDG] (last updated June 29, 2021). By July 2021, six bills related to antitrust reform were introduced on the floor of House of Representatives, aimed at restraining Big Tech. 152 See Augmenting Compatibility and Competition by Enabling Service Switching (ACCESS) Act, H.R. 3849, 117th Cong. (2021) (mandating that platforms collecting user information must make such information portable and interoperable with other services); Merger Filing Fee Modernization Act of 2021, H.R. 3843, 117th Cong. (2021) (increasing merger approval fees for large mergers to fund enforcement activities by the FTC and DOJ); Platform Competition and Opportunity Act of 2021, H.R. 3826, 117th Cong. (2021) (prohibiting dominant firms from acquiring, directly or indirectly, the stock or assets of any actual or potential competitors); Ending Platform Monopolies Act, H.R. 3825, 117th Cong. (2021) (prohibiting dominant online platforms from leveraging their monopoly power to distort or destroy competition in markets that rely on that platform); American Choice and Innovation Online Act, H.R. 3816, 117th Cong. (2021) (prohibiting companies that run designated platforms from self-preferencing their business in those marketplaces); State Antitrust Enforcement Venue Act of 2021, H.R. 3460, 117th Cong. (2021) (ensuring that state attorneys general who bring antitrust cases in federal court do not face delays or high costs due to the transfer of such cases to different venues). The proposals could make it much harder for companies like Amazon to use their dominance in one market to promote their products in another market or acquire nascent rivals. 153 David McCabe & Steve Lohr, Congress Faces Renewed Pressure to ‘Modernize Our Antitrust Laws’, N.Y. Times (June 29, 2021), https://www.nytimes.com/2021/06/29/technology/facebook-google-antitrust-tech.html (on file with the Columbia Law Review). The proposals would also empower enforcers to more easily break up businesses that engage in anticompetitive behavior. 154 Cecelia Kang, Lawmakers, Taking Aim at Big Tech, Push Sweeping Overhaul of Antitrust, N.Y. Times (June 11, 2021), https://www.nytimes.com/2021/06/11/technology/big-tech-antitrust-bills.html (on file with the Columbia Law Review).

If this momentum does bring about any reform in the coming years, the history of the rise and fall of the RPA imparts important lessons. First, the RPA provides an example of existing antitrust law that does not necessarily conform to the consumer-welfare standard. Promoting efficiency and lower prices for consumers is not the focal point of the RPA, which has made economists and Chicago School antitrust lawyers wary of its appropriateness. 155 See supra Part I. The focal point was rather on protecting small sellers and fair market competition. But if Congress is intentional and vocal about the new antitrust laws considering factors other than price efficiency, nothing stops Congress from doing so. It has done it before.

Second, even if Congress passes new antitrust laws, courts may be slow to adopt change without simplified guiding principles to complement the legislative reform. What diluted the RPA’s potency was not only enforcers’ lack of willingness to enforce the Act but also the broad trend in the field of antitrust toward economics-driven calculations to prove injury. 156 Berman, supra note 3; see also supra notes 127–128, 145–146 and accompanying text. Statistical analyses that rely on a myriad of economic assumptions inherently bear the risk of error. The task for judges in RPA and other antitrust cases has become more difficult as the analyses employed have become more technical to meet the evidentiary burden. Parties have become more reliant on economic expert witnesses to prove or deny antitrust injury. Unless enforcers find ways to simplify the antitrust analysis, courts with lay judges could be mired in painstaking economic analysis that could delay real reform.